Benjamin Franklin famously wrote "In this world nothing can be said to be certain, except death and taxes." I propose adding VAT rate changes to that list of inevitabilities. Occasionally the rate of sales tax businesses are required to charge will vary over the years. In this blog post I'll demonstrate how to handle such VAT rate changes in WHMCS.

Preparing for VAT Rate Changes

First a little planning. The tax rate is determined at the point an invoice is generated, so it's important to be ready to make the change at the deadline, typically at midnight. The new rate will apply to invoices generated after the change; existing invoices will keep the previous rate. If you accidentally miss the deadline and some invoices are created with the old tax rate, not to worry, I'll cover that later. Executing a VAT Rate Change

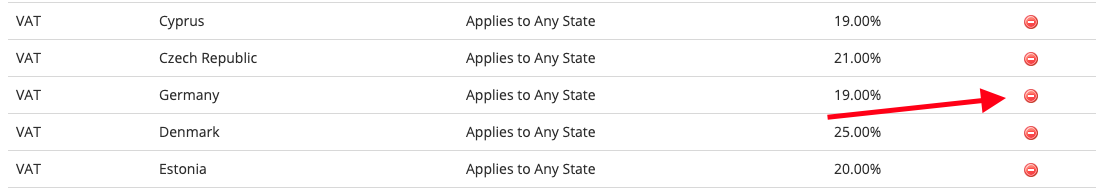

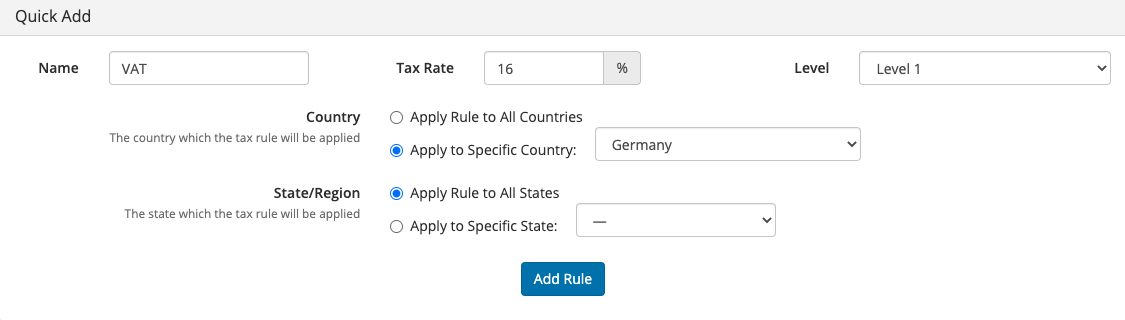

For the purposes of this example, the German VAT rate (known as USt) decreased to 16% on 1st July 2020. Therefore at midnight on 30th June (or at the latest before the daily automation tasks run on the 1st July for generating new invoices), you should update the tax rules so that new orders and invoices use the higher rate. This is done via the WHMCS admin interface under Setup > Payments > Tax Configuration:

- Click the Tax Rules tab

- Delete the original tax rule by clicking the corresponding red delete icon:

- Create a new tax rule with exactly the same name, country and state but enter the new tax rate:

- Click Add Rule

Adjusting VAT Rates on Individual Invoices

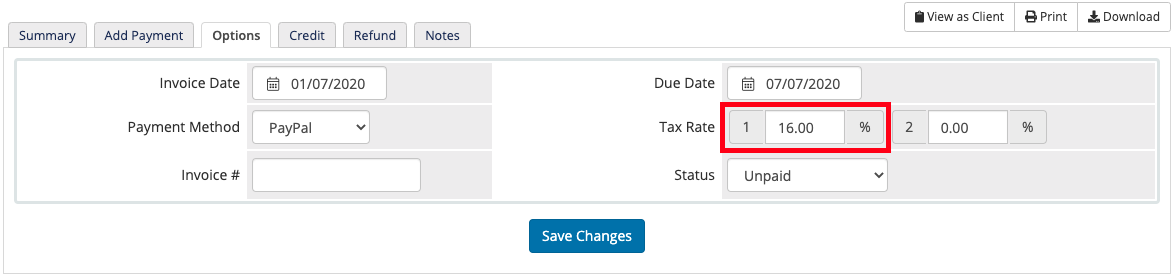

If the deadline was missed and invoices are generated with the old tax rate, it is possible to change the tax rate on individual invoices. First, I'd suggest checking with your accountant whether this action is permissible in your locale; the tax authority may have an implementation period to allow for this. Login to the WHMCS Admin interface and navigate to Billing > Invoices > Unpaid:

- Click on the invoice number

- Click the Options tab

- Enter the new rate into the Tax Rate field:

- Click Save Changes

Subscriptions and VAT Rate Changes

If you are operating in Exclusive tax mode, or have the Deduct Tax Amount option enabled, VAT rate changes may result in a new invoice total compared with the previous invoice. This will have an impact for those clients paying via a fixed amount subscription agreement - such as those offered by PayPal and 2Checkout. This will require manual intervention in order to ensure clients are paying the correct new amount. If you know this will affect you, I recommend cancelling and creating a new PayPal subscription from the next invoice issued to avoid any overpayments or interruptions in service.

Further Reading

As ever, we are not tax experts, and would strongly recommend anybody with any questions or concerns regarding tax rate changes seek appropriate advice from your local Tax and VAT Authority. Below I've also highlighted some of the most useful links I've found: Changing Tax Rate How-To Guide:https://docs.whmcs.com/How_To_Guides#Change_Tax_Rate

Tax Configuration Documentation:https://docs.whmcs.com/Tax_Configuration

EU Commission Information:https://ec.europa.eu/taxation_customs/taxation/vat/how_vat_works/telecom/index_en.htm

UK HMRC Guidance on Supplying Digital Services:https://www.gov.uk/government/publications/vat-supplying-digital-services-to-private-consumers

VAT Rates by Country:https://ec.europa.eu/taxation_customs/resources/documents/taxation/vat/how_vat_works/rates/vat_rates_en.pdf