In WHMCS 7.7, we've made working with taxes a whole lot easier.

Through a combination of new functionality, as well as updates and improvements to existing features, here's a run down of the biggest changes to be aware of:

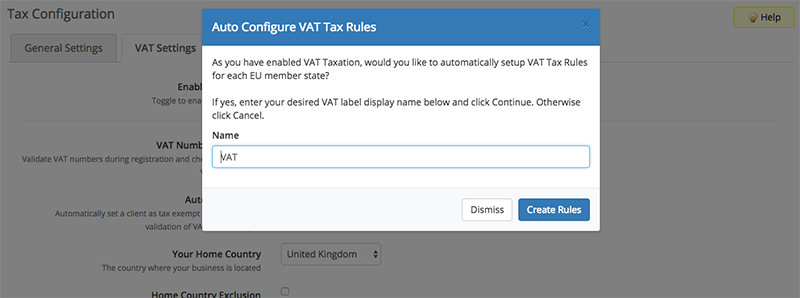

1. Easier Tax Setup & Configuration

It's now easier than ever to get started with WHMCS. A simple toggle button allows you to enable and disable all Tax related functionality throughout the product. For European businesses, a new VAT Mode option also available within the Tax Configuration setup pages allows you to enable and disable Value Added Tax related functionality at the click of a button.

Toggle VAT Mode on, and WHMCS will also offer you the option to have VAT rules created automatically for all 28 EU member states. Existing users can also use this functionality at any time to synchronise and ensure tax rules are up-to-date and correct.

With VAT Mode enabled, VAT Numbers can optionally be provided by customers during signup. When provided, VAT Numbers are automatically validated using the VIES VAT Number Validation Service and invalid VAT Numbers are rejected. Those customers with valid VAT Numbers will be exempted from VAT charges where appropriate, automating and simplifying adherence to VAT regulations.

Also gone is the EU VAT addon, with all EU VAT related functionality now relocated and available natively within the Setup > Tax Configuration page.

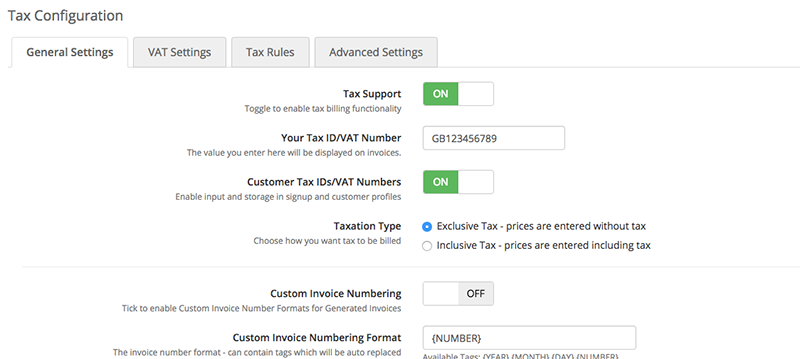

2. Tax ID Support

Now you can provide your own Tax Identification or VAT Number and have this displayed on invoices automatically. Through a new field made available in Setup > Tax Configuration, you can now always be sure that invoices issued by WHMCS will contain your Tax ID or VAT Number.

3. Native Customer Tax ID/VAT Number Support

Until now, customer Tax IDs and VAT Numbers have always been handled using custom fields. Starting in WHMCS 7.7, we've added native fields that allows Tax IDs and/or VAT Numbers to be stored in customer and contact profiles. This makes storing, searching and working with Tax IDs easier, and Tax IDs are now more easily discoverable via Intelligent Search.

Tax IDs can also now be set as part of a billing contact, and when set, Customers Tax IDs will be displayed on invoices along with the customers name and address.

Because we know many users today are using custom fields for collecting and tracking Tax IDs and VAT Numbers, we're also providing a utility that enables you to migrate existing values stored in a custom field into the new native fields.

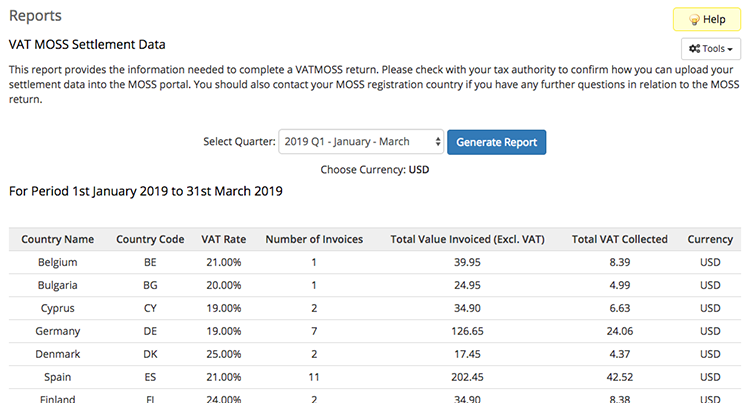

4. Improvements to Reporting

New functionality in WHMCS 7.7 means that every invoice generated will have the customers billing country stored along with it. The result is that should a customer make changes to their billing address following an invoice having been issued, the VAT MOSS report will still reflect the income under the country that the invoice was originally issued to. Any changes to customer billing country settings will no longer affect reported amounts.

The VAT Moss report can be accessed via Setup > Reports.

Try the beta today

Join over 200 others who have already tried WHMCS 7.7 Beta. Be among the first to try out new features such as this and the many other features available in WHMCS 7.7 including intelligent search improvements, CodeGuard Website Backup, Inactive Clients Hiding, FraudLabs Pro and more. Get involved for the chance to help influence feature direction before the final release and to be in with a chance of winning some exclusive WHMCS branded items.

WHMCS 7.7 is available in beta now, learn more and get involved at https://preview.whmcs.com/